News

Career News | Mar 31, 2024

On March 21-22, we hosted 10 incredible alumni for the 2024 Economics Undergraduate Career Forum for two days of networking and career development programming! More than 150 students attended.

Career News | Mar 17, 2024

The ECO is excited to host ten of our amazing alumni this Thursday and Friday for the annual Economics Undergraduate Career Forum! Check out the events happening below (students, register!).

Career News | Mar 01, 2024

On February 20th, the ECO hosted How I Got This Job: Data Analytics with Nigel Brooks, Business Intelligence Analyst from Major League Soccer!

Career News | Feb 25, 2024

Career News | Feb 18, 2024

Omna Berhanu, UVA Economics student, participates on a panel about "Careers in Economics" at the SACE conference! Moderated ny Quentin Johnson, University of Chicago.

Undergraduate News | Feb 16, 2024

Congratulations to the Co-Founders - Rachel Choi, Elizabeth Berman, Natasha Swindle and Ravza Aykan - for a terrific event and thank you for your leadership!

Career News | Jan 30, 2024

Want to learn about graduate programs you may choose to pursue with your economics degree? Consider attending in the fall, in the future, and full or part-time.

Career News | Jan 11, 2024

Sent 12/15/23

Dear Alumni and Friends,

Department News | Jan 08, 2024

Graduate News | Dec 04, 2023

Diego Briones, a PhD candidate, published a brief on the Public Service Student Loan Forgiveness Program (PSLF) as part of Third Way's ACADEMIX Upshot series.

| Nov 21, 2023

As 2023 draws to a close we wish to share with you some highlights!

Women in Economics:

Career News | Nov 13, 2023

Fall 2023 Career Programs from the Economics Career Office (ECO)

Department News | Nov 13, 2023

Career News | Nov 13, 2023

ECO Thanksgiving Message

Hello Economics Majors!

I hope your Thanksgiving week is off to a great start.

Department News | Nov 13, 2023

Career News | Nov 13, 2023

How to Network When You Can't Meet up with People

Wall Street Journal 6/14/2020

Career News | Nov 12, 2023

Event Date: November 14th, 2023

Event Time: 5:30pm-6:30pm

Location: Monroe Hall, Room TBD

Career News | Nov 07, 2023

These are the ECO's comments written by Jen Jones, Director, Edwin T. Burton Economics Career Office

Career News | Nov 05, 2023

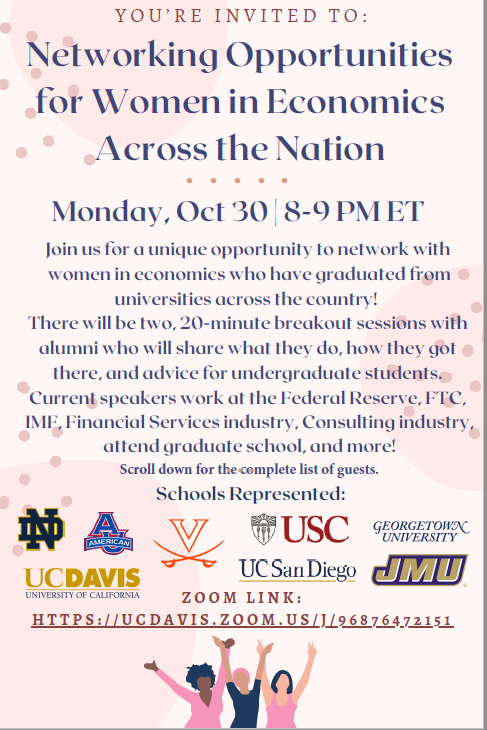

Women in Economics Career Talk [Sponsored by the ECO and the Econ Club] Bios Follow this Description

When: Friday, November 10, 11am-12pm

Career News | Nov 05, 2023

Investment Banking - How to Win Deals

Event: Investment Banking - How to Win Deals

Date: Thursday, November 9th

Career News | Oct 17, 2023

WHAT OTHERS ARE SAYING

Career News | Oct 17, 2023

UVA's Department of Economics has joined

UVA's Department of Economics has joined

Career News | Oct 10, 2023

Panelist Bios will be listed below the flyer on Wednesday, 10/11/23.

Panelist Bios will be listed below the flyer on Wednesday, 10/11/23.

Career News | Sep 17, 2023

Article written by Amy Gallo for Harvard Business Review

No one likes job hunting. Scouring through online job listings, ... [...]

Career News | Jun 28, 2023

From The Wall Street Journal, 6/16/23

Career News | May 01, 2023

The following comments are responses to The Wall Street Journal article "Does Your Resume Pass the Six-second Test?"

Career News | Mar 13, 2023

Employers are finding personality tests — measuring how employees think and feel — more useful than ever while navigating hybrid work. But the tests are not always up-to-date.

Career News | Feb 26, 2023

The Economics Undergraduate Career Forum brings together professionals who hold undergraduate economics degrees with current students and faculty through networking events and educational programming to expose majors and prospective majors to... [...]

Career News | Jan 07, 2023

Article "I'm a designer at LinkedIn.

Career News | Dec 13, 2022

Click on the link below to access the Class of 2021 First Destination Report.

Career News | Nov 28, 2022

What’s the Ideal Length for a Cover Letter? —Plus Tips to Get Yours There

Career News | Nov 22, 2022

Top 6 Skills Employers Are Looking for in Recent Grads in 2022

Article from The Muse

Career News | Oct 24, 2022

Investment Banking Coffee Chat Questions

Career News | Oct 24, 2022

Thanks to our friends at UCBerkeley, below is some solid information about employer information sessions and why the ECO encourages you to attend these programs.

Career News | Sep 25, 2022

The Best Way to Brag About Your Accomplishments: Don’t Take All the Credit

If you want your accomplishments to really sing, give someone else’s hard work a shout-out, a study finds

Career News | Sep 05, 2022

Articles from The Balance Careers, written by Alison Doyle updated on February 13, 2020 and November 11, 2021.

Graduate News | Aug 01, 2022

Daniel Harper, a fifth-year student, presented his paper “Borrowing in A Crisis: An Experimental Study of Asset-Backed Borrowing in a Financial Downturn,” at the Economic Science Association Word M

Career News | Jul 05, 2022

Graduate News | May 23, 2022

Gayoung Ko, a sixth-year student, presented her paper, "Gender Discrimination in the Gig Economy: Evidence from Online Auctions for Freelancing," at the International Industrial Organization Confer

Graduate News | May 23, 2022

In April 2022, fifth-year student Yooseon Hwang presented her paper,"The Welfare Effects of Congestion Pricing," at the European Urban Economics Association Conference in London. The paper estimate

Graduate News | May 23, 2022

In May 2022, 6th-year student Joaquin Saldain presented his paper, "A Quantitative Model of High-Cost Consumer Credit," at the Midwest Macroeconomics Conference in Logan, Utah.

Graduate News | May 23, 2022

Graduate students Tyler Wake and Mrithyunjayan (MJ) Nilayamgode attended the Midwest Macro Conference at Utah State University in Logan, Utah on May 20 and 21, 2022.

Graduate News | May 05, 2022

Econ Grads enjoyed a study break with fresh air, open vistas, exercise, and comradery on a hike in the Blue Ridge Mountains organized by the Graduate Economics Club

Career News | Apr 19, 2022

In-demand college students seeking summer internships are reneging on offers as companies swoop in to offer better deals. Host J.R.

Career News | Apr 11, 2022

Below is a WSJ article about finding a professional mentor virtually, on the job or off. Many resources are recommended.

Career News | Apr 04, 2022

As employers struggle to fill millions of openings, applicants are using their leverage to forgo what, until recently, was a must for landing a decent job

Career News | Feb 24, 2022

Great Advice from Capital One for Virtual Interview Preparation (This advice applies to more than Cap One interviews.)

7 Tips to Nail Your Virtual Interview

Career News | Feb 22, 2022

A Graduate Degree That Pays Off: The M.B.A.

A Wall Street Journal analysis of federal student loan data found 98% of programs leave students with manageable debt loads

Career News | Feb 08, 2022

From the National Association of Colleges and Employers, NACE Job Outlook 2022

Career News | Jan 31, 2022

Hello Econ Majors,

Graduate News | Jan 31, 2022

Snigdha Das presented her paper, "Corruption and the Golden Goose Effect in the Context of an Ink Bomb Task Experiment," which studies corrupt behavior across a dynamic setting.

Graduate News | Jan 31, 2022

The 2021 Snavely Outstanding Summer Paper Prize was awarded to Joe Anderson (not pictured here), for Institutional Strategies and Debt Maturity; Yang Yu, for Venture Capital and the Dy

Career News | Jan 31, 2022

Below the ECO is sharing the 10 Best Jobs for Introverts as written by The Muse. Our majors may be particularly interested in numbers 1, 5, 9, and 10. But they are all worth a glance!

Career News | Jan 25, 2022

If you’re looking for the chance to connect with recruiters and stand out in your job or internship hunt, Handshake’s new virtual career fairs are meant for you!

Graduate News | Jan 18, 2022

Career News | Jan 11, 2022

Hello Majors,

Career News | Jan 09, 2022

*This article offers great insight into today's hiring climate. Keep these tips in mind with your own job search.

Career News | Jan 06, 2022

The ‘Best Job in America’ Pays up to $125,000 a Year—and Has 10,000 Job Openings

Career News | Dec 14, 2021

From the National Association of Colleges and Employers (NACE), November 2021, by Kevin Gray

From the National Association of Colleges and Employers (NACE), November 2021, by Kevin Gray

Career News | Dec 01, 2021

Hello Econ Majors,

With finals just ahead of us, I'm sure you're focused on preparing for your exams and papers.

Wishing you great success in the next few weeks.

Graduate News | Dec 01, 2021

Fifth-year student Jiafeng Wu presented his paper, "Price and Efficiency in a Market for Generic Drugs in China," at the Models of Modern Markets session of the 91st SEA Annual Meeting.

Graduate News | Dec 01, 2021

Joaquin Saldain, a sixth-year student, presented his paper, "A Quantitative Model of High-Cost Consumer Credit," at the 2021 Annual SEA, LACEA LAMES and NTA Meetings.

Graduate News | Dec 01, 2021

Daniel Harper, a fifth year graduate student, presented two of his papers at the Economics Science Association's 2021 North American Meeting in Tucson, AZ. The first paper, “The efficient market h

Graduate News | Dec 01, 2021

The Department of Economics is pleased to welcome the inaugural cohort of Bridge to the Doctorate Fellows, starting in Fall 2021: Abigail Matthew and Fatimah Shaalan.

Graduate News | Dec 01, 2021

Yutong Chen, a fourth-year graduate student, presented her paper at the Southern Economic Association’s 2021 Meeting in Houston, TX. The paper, “Does the Gig Economy Discriminate?

Career News | Nov 22, 2021

Looking for a J-Term elective that combines career skills development, career exploration, and academic credit?

Career News | Nov 21, 2021

Hello Econ Majors!

I hope your Thanksgiving week is off to a great start.

Career News | Nov 18, 2021

Taken from the National Association of Colleges and Employers

NACE Journal, August 2020

Career News | Nov 09, 2021

By: Derek Loosvelt at Firsthand

Published: Nov 07, 2021

Career News | Nov 02, 2021

Younger firms are driving office leasing in the city

Career News | Nov 02, 2021

For our students who have a general interest in business, but are less focused on the industry or a particular job function, these programs may be for you.

Career News | Oct 26, 2021

Greetings Majors!

There are two virtual job fairs this week, which I recommend for our majors:

Career News | Oct 18, 2021

By: Victorio Duran III at Firsthand

Career News | Oct 10, 2021

Hello Economics Majors,

Career News | Sep 28, 2021

Sleep and productivity experts weigh in on how to get your morning mojo back; ‘Whatever you do, don’t log on to your work email’

Career News | Sep 16, 2021

by Lucy Manole | September 08, 2021 from Vault

Career News | Aug 30, 2021

Conversations with Employers: CIA and World Bank

Career News | Aug 30, 2021

I subscribe to The Wall Street Journal. You can read it for free through the UVA library. Here's a recent piece I thought our students would enjoy this week.

Career News | Aug 24, 2021

How Oracle plans to recruit for its East Bank campus, the No. 1 trait that makes someone an attractive hire

Career News | Aug 24, 2021

To Gen Zers Working From Home, the Office Is a Remote Concept

Career News | Aug 16, 2021

How to Write a College Resume That’ll Get You Hired (Plus an Example!)

by Meredith Pepin at The Muse

Career News | Aug 11, 2021

Vault:

by Victorio Duran III | August 05, 2021

Career News | Aug 08, 2021

Taken from Hubspot; To read the full article, click here: https://blog.hubspot.com/sales/relationship-building-email-te

Career News | Aug 01, 2021

A KKR talent exec says the private-equity firm’s college recruiting is expanding beyond core target schools

Career News | Aug 01, 2021

August 2, 2021

Hello Economics Majors,

Career News | Jul 31, 2021

This message was shared by the UVA Career Center for those students interested in management consulting careers.

Career News | Jul 31, 2021

This message was shared by the UVA Career Center for those students interested in management consulting. This is message #3 of 3. For additional information, see Collab/ECO Resources/Vault Guides/C

Career News | Jul 31, 2021

This message was shared with the ECO from the UVA Career Center for students interested in management consulting careers. This is message 1 of 3.

Career News | Jun 28, 2021

17 Tips to Get the Most out of Your Virtual Internship

Career News | Jun 28, 2021

How to Make the Most of Your Summer Internship/Work Experiences

Graduate News | May 07, 2021

Brett Fischer presented his paper, "No Spending without Representation: School Boards and the Racial Gap in Education Finance," at the Urban Economics Association's European meeting.

Graduate News | Jan 15, 2021

PhD candidate Brett Fischer presented his paper, "No Spending without Representation: School Boards and the Racial Gap in Education Finance," at the National Tax Association's 2020 Annual Conferenc

Graduate News | Jan 14, 2021

UVA PhD student Yen Ling Tan's joint work with University of Auckland economist Simona Fabrizi, “Consumer (and Driver) Decision-Making under Uncertainty on Digital Platforms,“ was presented at the

Graduate News | Jan 14, 2021

Haruka Takayama presented her job market paper, "Greenfield or Brownfield?

Graduate News | Jan 14, 2021

Daniel Harper, a 4th year doctoral student, coauthored "Capital constraints and asset bubbles: An experimental study," with Professors Lee Coppock and Charles Holt. The paper was published in the

Graduate News | May 12, 2020

Graduate News | May 01, 2020

Graduate News | May 01, 2020

In October 2019, Devaki Ghose won the Graduate Student Award at the 2019 Empirical Investigations in International Trade Conference for her paper "Tra

Graduate News | Apr 22, 2020

Yooseon Hwang has been awarded a 2020 Arts, Humanities and Social Sciences (AHSS) Summer Research Fellowship for her research on how traffic congestion and environmental amenities affect home price

Graduate News | Apr 22, 2020

Hundanol presents his paper, “The gains from market integration: The welfare effects of new rural roads in Ethiopia,” at the Midwest International Conference on Development Economics (MWIEDC), held

Graduate News | Apr 22, 2020

Haruka Takayama Hasegawa, winner of an All-University Graduate Teaching Award for her dedication to undergraduate teaching and outstanding achievement in that area, is recognized in UVA Today's art

Graduate News | Mar 25, 2020

Moogdho Mahzab, a fifth year PhD student of Economics, presented his paper "Dishonest Politicians and Public Goods Provision" at the Pacific Conference for Development Economics (PacDev) 2020, host

Graduate News | Mar 20, 2020

Hundanol Kebede presented his paper, titled “The gains from market integration: The welfare effects of new rural roads in Ethiopia,” at the Pacific Conference for Development Econo

Graduate News | Mar 19, 2020

Brett Fischer presented a paper, "No Spending Without Representation: School Boards and the Racial Gap in Education Finance," at the AEFP's 45th Annual

Graduate News | Mar 06, 2020

Amzad Hossain, 4th year PhD student, presented his paper on "The Match Between `She' and `Her': Performance Gains from Gender Match in Higher Education" at the Eastern Economic Conference in Februa

Career News | Feb 05, 2020

Interested in public service or non-profits? Sign up to attend the PSG Non-profit and Government Career Fair in DC to network with other like-minded peers and professionals in public service.

Career News | Jan 17, 2020

Things just haven't been the same without you! As you get back into the rhythm of the semester, keep an eye out for upcoming ECO events and networking opportunities on Handshake.

Career News | Dec 18, 2019

As finals draw to a close, we here at the ECO are thinking about what information would be most helpful to share for your use over winter break. So, we’ve compiled a list of odds and ends, some of

Graduate News | Dec 11, 2019

In November, Ramiro Burga presented his paper “Fixing an Instructional Mismatch: The Case of Bilingual Education among Indigenous Students in Peru” at the 2019 Fall Research Conference of the Assoc

Graduate News | Dec 11, 2019

In November 2019, Ekaterina Khmelnitskaya and Miguel Mascarua presented their research at the annual conference organized by the Southern Economic Association in Fort Lauderdale, Florida.

Graduate News | Nov 26, 2019

The announcement, made on Twitter, can be found here: https://mobile.twitter.com/ASHE_ASSA/status/1197849863582552069 .

Graduate News | Oct 21, 2019

Devaki Ghose (job market candidate) and Moogdho Mahzab (5th year student) presented their work at the 2019 Urban Economics Association (UEA) conference in Philadelphia (hosted by the Federal Reserv

Graduate News | Oct 04, 2019

Alex Gross presented his job market paper, "Private Labels and Bargaining in the Supply Chain: The Case of Wine," at the 46th Annual Conference of t

Graduate News | Oct 04, 2019

Graduate students from every cohort stepped away from their work to hike White Oak Canyon trails, one of the most popular trails in Central Virginia.

Graduate News | Sep 26, 2019

Please welcome the 2019 Graduate Economics Club Committee members, from left to right: Danielle Parks (1st year), Suchi Akmanchi (2nd year), Dan Harper (3rd year), Joe Anderson (1st year), Fiorella

Graduate News | Sep 20, 2019

We are delighted to welcome the 2019 cohort to the graduate program. Their rigorous orientation included the ritual Econ Grad Soccer Match and Welcome Party, pictured below.

Career News | Aug 20, 2019

by: Laura Katen for The Muse

Career News | Aug 17, 2019

9 Tips for Thinking on Your Feet When You're Put on the Spot and Have to Sound Smart

By: Stacey Lastoe

Career News | Aug 17, 2019

The Best Ways to Imrove Your Communication Skills

By: Melanie Pinola

Graduate News | Aug 06, 2019

In May 2019, Diego Legal-Cañisá presented his JMP on "Unemployment Insurance and Consumer Bankruptcy" at the 9th European Search & Matching Network Conference in Oslo, Norway, attended by promi

Graduate News | Jul 24, 2019

In April 2019, Emily Cook presented “College Choice and Intended Major in the U.S.” at the International Industrial Organization Conference in Boston, MA.

Graduate News | Jul 19, 2019

Graduate News | Jul 19, 2019

In June, 2019, Diego Legal-Cañisá presented his paper "Unemployment Insurance with Consumer Bankruptcy" at the North American Meeting of the Econometric Society in Seattle, Washington. The data sho

Graduate News | Jul 19, 2019

Career News | Jul 18, 2019

Any Questions? What to Ask in an Interview

Career News | May 13, 2019

Tips for Making the Most of Your Summer Internship/Job

Compiled by Sabrina Grandhi (Econ 2019, Consultant Cornerstone Research

Graduate News | May 08, 2019

In the Econ Department's 2019 Economic Research Conference (ERC), from April 30th to May 2nd, our third year graduate students presented and defended their dissertation proposals. The picture shows

Career News | May 07, 2019

Taken from The Muse: https://www.themuse.com/advice/5-ways-to-look-confident-in-an-int

Career News | Apr 21, 2019

Making the Most of Your Internship (from Goodcall https://www.goodcall.com/career/internship-tips/)

Career News | Apr 15, 2019

#1. Start a service-based business.

Unless you’ve got a reliable summer job, there’s probably a whole host of benefits to make your summer money working on your own terms.

Graduate News | Apr 15, 2019

Alex Gross presented his paper, "Private Labels and Bargaining in the Supply Chain: The Case of Wine," at the International Industrial Organization Conference in Boston, MA, in April 2019.

Career News | Apr 01, 2019

10 Great Skills You Can Teach Yourself

Graduate News | Mar 27, 2019

In fall of 2018, 1st year student Mrithyunjayan Nilayamgode presented a paper at the Northeast Universities Development Consortium (NEUDC) conference on development economics at Cornell University

Graduate News | Mar 14, 2019

Third year PhD student Joaquin Saldain won the Economic Department's Tipton Snavely Award for Best Summer Paper (an honor he shares with Ga Young Ko). Joaquin describes the key iss

Graduate News | Mar 14, 2019

Computational technologies are exploding in their ability to analyze complex scientific problems.

Career News | Mar 04, 2019

If you're planning to interview with one of the Big 4 professional firms—Deloitte,

Career News | Feb 20, 2019

What can you do with an economics major? Almost anything!

Career News | Feb 20, 2019

What can you do with an economics major? Almost anything! Join the economics department for a series of career talks and office hours, as well as two career panels moderated by our faculty.

Graduate News | Jan 18, 2019

Career News | Jan 15, 2019

New UVA Programs with iXperience to Offer Liberal Arts Credit, Skills Development, and Practical Experience in Africa and Europe

Career News | Jan 08, 2019

The stress. The anxiety. The worry. All of us have those moments where we’re completely overwhelmed by the amount of work college demands.

Career News | Dec 12, 2018

Diversity recruiting has been the subject of several posts over the last few weeks. Although there are existing WSO posts that try to aggregate opportunity for diverse candidates, this one aims to be an exhaustive list that includes all the... [...]

Graduate News | Dec 11, 2018

On October 6, at the 74th Midwest International Trade Conference at Vanderbilt University, I presented my job market paper, “Learning, Externalities, and Export Dynamics,” in a 25-minute talk to a

Graduate News | Dec 11, 2018

On October 6, at the 74th Midwest International Trade Conference at Vanderbilt University, I presented my job market paper, “Learning, Externalities, and Export Dynamics,” in a 25-minute talk to a

Career News | Dec 07, 2018

Alumni Spotlight: DAVID NEUMAN, Principal at Trammel Crow Company

Career News | Dec 06, 2018

New technologies are popping up daily, and automation is on the rise.

Graduate News | Nov 27, 2018

Megan Miller presented her paper “Labor supply responses to in-kind transfers: The case of Medicaid” at the 111th Annual National Tax Association Conference in New Orleans, Louisiana. Research pr

Career News | Nov 27, 2018

This article covers how AI may affect your internship and job search, and how you may be able to influence this by managing your electronic footprint and social media presence.

Title: Wanted: The ‘perfect babysitter.’ Must pass AI scan for... [...]

Career News | Nov 20, 2018

Alumni Spotlight: Joy Fan, Media Relations & Marketing Associate at the American Enterprise Institute

Career News | Nov 15, 2018

For someone new to the job market, it can be difficult to determine what to include on both the résumé and cover letter. You may feel that you have no experience to include, and your work experience could be non-existent or very limited.

Career News | Nov 08, 2018

No matter your field, there's plenty of selling in the job search, with prospective employers as buyers for the products, which are the applicants themselves. As a result, sales skills matter, and they get a lot of attention. But they're mostly... [...]

Graduate News | Nov 01, 2018

The Macro Financial Modeling (MFM) Summer Session, organized by the University of Chicago's Becker-Friedman Institute, is designed for early-career professionals and doctoral students in economics

Graduate News | Nov 01, 2018

Cailin Slattery presented two papers at the recent International Institute of Public Finance (IIPF) conference in Tampere, Finland; "Campaign Spending and Corporate Subsidies: Evidence from Cit

Career News | Nov 01, 2018

Consider this article as a source for employment!!! At least 4 potential employers are cited.

Graduate News | Nov 01, 2018

Cailin Slattery presented her job market paper "Bidding for Firms: Subsidy Competition in the U.S." at the Urban Economics Association Meeting at Columbia University in New York City.

Career News | Oct 31, 2018

Alumni Spotlight: Emily Steinhilber, Research Associate Professor at Old Dominion University

Career News | Oct 30, 2018

A common complaint job seekers make is, “I don’t have a network!” It’s very frustrating to realize job search networking is the best way to land an opportunity but to believe that avenue isn’t open to you. Luckily, you do have a network! Learn... [...]

Career News | Oct 10, 2018

Alumni Spotlight: EDEN GREEN, Allison Partners

Life before UVA:

Graduate News | Oct 05, 2018

This short course provided training on impact evaluation on quasi-experimental research. Participants learnt about important econometric techniques used in policy research design.

Career News | Sep 25, 2018

Impressing a stranger, standing out from the competition, earning an offer—these are all challenges, even for an experienced professional who should be a perfect fit.

Why?

Graduate News | Sep 24, 2018

Dan Savelle presented his paper, “Discrete Choices with (and without) Ordered Search,” at the 45th Annual Conference of the European Association for Research in Industrial Economics (EARIE) in a Ri

Graduate News | Sep 24, 2018

Our very own Haruka Takayama Hasegawa was recognized by UVA's Center for American English Language and Culture (CAELC) for her generous contributions to the VISAS program.

Career News | Sep 23, 2018

Taking place next Thursday (9/27) and Friday (9/28), the Careers in Marketing forum is a unique opportunity for students to learn from a diverse group of Marketing alum representing many different

Career News | Sep 20, 2018

By Andy Meeks

Career News | Sep 17, 2018

Interview invitations should really come with a warning: Strong feelings of excitement changing suddenly into dread are imminent upon receiving this invitation.

Graduate News | Sep 12, 2018

It is a yearly tradition for current Econ graduate students to meet, greet, and challenge the incoming class to a friendly soccer game.

Graduate News | Sep 12, 2018

In 2017, the Department of Economics at Dartmouth College began a Visiting Ph.D. Program in International Economics.

Career News | Sep 11, 2018

Some would argue that it’s easier to write a novel than it is to craft an effective cover letter opening.

Graduate News | Sep 11, 2018

The UVA Department of Economics is delighted to welcome its incoming class of graduate students. The cohort of 20 students is equally divided with regards to gender.

Career News | Aug 24, 2018

,Career News | Sep 09, 2018

We are pleased to invite you to the 2018 IIT Stuart - Princeton Fintech and Quant Conference at IIT Stuart School of Business in Downtown Chicago, IL.

Career News | Aug 30, 2018

Q: What’s So Special about This Article?

A: There are several potential employers included, which were sources of information for the piece. How many can you find?

Career News | Aug 24, 2018

,Career News | Sep 09, 2018

We are pleased to invite you to the 2018 IIT Stuart - Princeton Fintech and Quant Conference at IIT Stuart School of Business in Downtown Chicago, IL.

Career News | Aug 24, 2018

Career News | Jul 12, 2018

Graduate News | Jul 11, 2018

Graduate News | Jul 11, 2018

Amzad Hossain was one of 4 graduate students recently awarded a GIDI iGrant by UVA's Global Infectious Diseases

Graduate News | Jul 07, 2018

UVA Professor Federico Ciliberto, UVA PhD Candidate Emily E. Cook, and UVA alumnus and current UNC Professor Jonathan W.

Graduate News | Jun 20, 2018

The Graduate School of Arts and Sciences Council (GSASC) represents the interests of graduate students at University of Virginia.

Career News | Jun 07, 2018

An extremely common interview question these days is some form of "What sets you apart from the rest of the candidates for this job?" Other incarnations of this question include "Why should we hire

Career News | Jun 07, 2018

One of the more common interview questions these days, especially for entry-level positions, is some form of "Why do you want to work for us?" Other forms of this question include "What attracts yo

Career News | Jun 05, 2018

Graduate News | Apr 15, 2018

In April 2018, 4th year student Devaki Ghose, presented a paper at a workshop--cohosted by the World Trade Organization (WTO), the International Monetary Fund (IMG), the World Bank (WB), and the Ce

Career News | Apr 06, 2018

25 SHORT, SWEET TIPS FOR SUCCESS AS A SUMMER INTERN

by Sarah Steenrod

Career News | Apr 05, 2018

"So… being an introvert does NOT mean you don’t have social skills. As career development folks, we all know this, right?

Career News | Mar 28, 2018

"The deal is the toast of the season globally.

Career News | Mar 07, 2018

"Networking. Just seeing the word is enough to make your palms sweaty and your mouth dry. When someone brings up the idea, you begin looking for a way to escape.

Career News | Feb 09, 2018

Career News | Jan 24, 2018

"The majority of applications for many jobs never get seen by a human.

Career News | Jan 18, 2018

The ECO and nine students trekked to the NYC area over Winter Break to visit two power-house firms run by economics majors.

Career News | Nov 20, 2017

"Over the Shoulder has been helping put smartphone-based qualitative into the toolkit of qualitative researchers and insight seekers for almost nine years now. We’re often asked by clients to list

Career News | Nov 14, 2017

"Have you ever felt like a fish out of water at a job?

Career News | Oct 20, 2017

by Samantha McGurgan

Career News | Oct 09, 2017

"Brian Tracy describes sales as the "ultimate default career." By that, he means that many people get into

Career News | Oct 02, 2017

"The irony of job search advice: There’s so much available that you don’t have to spend more than four seconds Googling before you land on some nugget of wisdom or another." - Jenny Foss

Career News | Oct 02, 2017

"When you haven’t updated your resume in a while, it can be hard to know where to start. What experiences and accomplishments should you include for the jobs you’ve got your eye on?

Career News | Sep 26, 2017

"You put together a solid resume and cover letter, and you’ve just been called in for an interview.

Graduate News | Aug 24, 2017

Graduate student Devaki Ghose was selected among young economists through a combination of written application and interviews to be

Career News | Aug 23, 2017

"It’s terrifying to know that the person you’re speaking to is weighing your every word—and could hold the power to change your future.

Career News | Aug 08, 2017

"These days, we do lots of things online. While this saves us a lot of time, it also demands more focus and concentration on our part.

Career News | Aug 07, 2017

"Every year, Vault surveys thousands of investment banking professionals, asking them

Career News | Aug 02, 2017

"You feel nervous about your career stories, and the fact that you have to tell stories in interviews drives you bananas. You're not sure whether your stories are even any good.

Graduate News | Jul 13, 2017

"The Role of Production Uncertainty in Teacher Performance Pay: Theory and Experimental Evidence", presented at the International Conference of the Association for Public Policy Analysis and Manage

Career News | Jul 02, 2017

"Receiving an invitation for a job interview can be an exciting time – especially after you’ve been job-searching for a while.

Career News | Jun 21, 2017

"One of your top priorities as a job candidate should be to end your interview with a power punch – something that’ll make you stand out and show your enthusiasm.

Career News | May 30, 2017

"If you're the analytical type, fascinated by the world around you, then an economics major might be a good choice for you.

Graduate News | May 04, 2017

Devaki Ghose presents her paper "Identifying the Role of Vertical Linkage in Agglomeration: Empirical Evidence from India" on Thursday, May 4th, 2017 in University of Nottingham, UK.

Career News | Feb 14, 2017

"I am often engaged to speak about innovation and strategy… not in an academic sort of way, people want to know how I took an idea and turned it into reality.

Career News | Feb 14, 2017

Goldman Sachs, Alibaba, Think Tanks and Non-profits - Read on!

Career News | Feb 07, 2017

Another Career Fair Approaches! New Job Postings! Economics Career Forum!

Career News | Feb 02, 2017

""For students who may be thinking about federal jobs and wondering how the hiring freeze impacts them, we want to highlight a few key points.

Career News | Jan 31, 2017

"If you’ve heard a lot about “soft skills” lately, it’s at least partly because employers want you to develop them.

Career News | Jan 31, 2017

Networking Programs! New Job Postings! Economics Career Forum!

Career News | Jan 20, 2017

ARTICLE- ARE YOU, LIKE, SAYING SOMETHING WITHOUT, LIKE, KNOWING THAT IT'S, LIKE, HURTING YOUR CAREER

"My bet is anyone born during the 1970s likely does it at least 10 times a day. Anyone born during the 1980s likely does it at least 20 times a day.

Graduate News | Jan 13, 2017

Career News | Jan 11, 2017

In his landmark 1985 book, Innovation and Entrepreneurship, famed author and educator Peter Drucker wrote about an entrepreneurial society and its impact on economic development.

Career News | Jan 10, 2017

Data Can Be Romantic! Volunteering: Good for your Heart!

Career News | Jan 09, 2017

Career News | Dec 22, 2016

"Hiring managers rarely have the time or resources to look at each résumé closely, and they typically spend about six seconds on their initial fit/no fit decision.

Graduate News | Nov 23, 2016

"This is definitely a great conference for macroeconomists and graduate students working on research.

Career News | Nov 01, 2016

Opportunities off the Beaten Path

Recruiting Timeline

Career News | Oct 17, 2016

"Today, Vault released its annual ranking of the 50 Most Prestigious Internships.

Career News | Oct 03, 2016

This newsletter from the ECO includes jobs and internships for economics majors, events, and workshops!

Career News | Sep 29, 2016

Read about 10 jobs that match up with many of the skills Economics majors are equipped with: https://www.thebalance.com/to

Career News | Sep 27, 2016

"We all know the question is coming: So tell me a little about yourself.

Career News | Sep 27, 2016

Career News | Sep 23, 2016

Part 1 of two articles on starting the career search as an Economics major, written by Professor Bill Conerly.

Career News | Sep 23, 2016

Part 2 of two articles for Economics majors, written by Professor Bill Conerly.

Career News | Sep 20, 2016

"University of Virginia graduate Dato' Chevy Beh envisions his startup, BookDoc, transforming health care in Asia just as tech behemoth Amazon has transformed retail around the world.

Career News | Sep 19, 2016

This week's newsletter is loaded with opportunities for economics majors, curated specifically for you!

Career News | Sep 12, 2016

Updates from the ECO with Jobs, Events, and Workshops!

Career News | Sep 12, 2016

Updates from the ECO with Jobs, Events, and Workshops!

Career News | Sep 05, 2016

Awesome events and job postings for econ majors! This week's prep programs for Career Fairs!

Career News | Aug 30, 2016

Economics Internship and Job Search Basics Workshops - Now open!

Career News | Aug 22, 2016

See tips on how to maintain the professional connections you make through your internship.

Career News | Aug 21, 2016

Job and Internship Search Basics Pre-reqisite Workshop Sign-up is Open!

Career News | Aug 12, 2016

Matt Chingos and Beth Akers from The Brookings Institution, who participated in an Econmics Career Office panel in 2013, have published their piece about student debt. You may find the piece in it

Career News | Aug 12, 2016

This article offers terrific advice about searching for jobs and internships overseas.

Career News | Aug 12, 2016

Article on: Are You a Parachute Counselor, by Dick Bolles

Career News | Aug 12, 2016

Corporate Economists are Hot Again

From The Wall Street Journal

By Bob Tita

Updated Feb. 27, 2014 6:01 p.m. ET

Career News | Aug 12, 2016

Graduate school interviews can be a nerve wracking process. Learn how to impress from this helpful article.

Career News | Aug 12, 2016

How do you use college to learn how to be an entrepreneur?

Career News | Aug 12, 2016

Read about how one company in Japan is encouraging it's employees to make healthy changes to improve their productivity. (you may need to log into Handshake to access this article).

Career News | Aug 12, 2016

Useful tips for making the best first impression in the business world.

Career News | Aug 12, 2016

Career News | Aug 12, 2016

It's easy to rely on Spellcheck, but you might be surprised by how many grammatical and spelling mistakes it can miss.

Career News | Aug 12, 2016

Large companies are hiring recruits first then assigning a job role to them later. Review the insightful comments at the bottom of the articles.

Career News | Aug 12, 2016

Is it possible to have a Tech career with a Liberal arts degree? Yes it is!

Career News | Aug 12, 2016

A Must-Read for Job Seekers from the National Association of Colleges and Employers (NACE)

Career News | Aug 12, 2016

A former Morgan Stanley intern, Ellen Jin, turned full-time Credit Risk Analyst talks about her experience with finding an internship and how she worked her way up to where she is now!

Career News | Aug 12, 2016

Venture capital interviews aren’t tricky. Generally, there are no brainteasers or case questions.

Career News | Aug 12, 2016

Julia Devlin, a former lecturer in the Economics department at UVA and now a senior fellow at the Brookings Institute, looks at the relationship between water scarcity and economic growth in the Mi

Career News | Aug 12, 2016

Tips on how to write a cover letter that could attract potential employers.

Career News | Aug 12, 2016

Test Your IQ (International Quotient) to See If Working Abroad Is for You

Career News | Aug 12, 2016

Factors to consider when negotiating your salary.

Career News | Aug 12, 2016

Be prepared to discuss Brexit in your next interview. The question will surely come up and you will want to be fully prepared to discuss it knowledgeably.

Career News | May 17, 2016

Career News | Aug 09, 2014

"Tough interview questions are supposed to challenge job candidates and make them think on their feet.